A company purchased 1800 of merchandise on july 5 – On July 5, a company made a significant purchase of merchandise amounting to $1,800. This transaction has far-reaching implications for the company’s inventory levels, financial statements, and overall business strategy.

The purchase of merchandise represents a crucial aspect of inventory management, as it directly impacts the availability of goods for sale. The company must carefully consider the type and quantity of merchandise purchased to meet customer demand while minimizing the risk of overstocking or understocking.

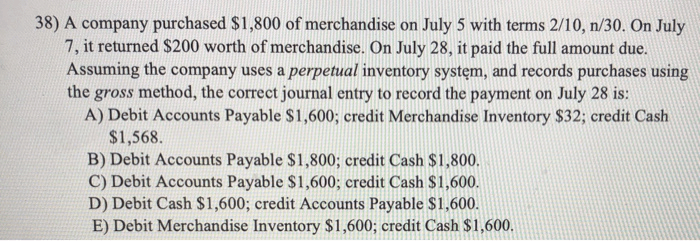

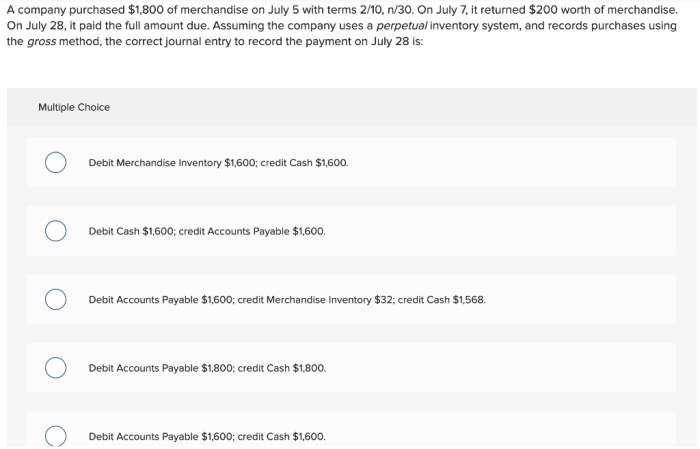

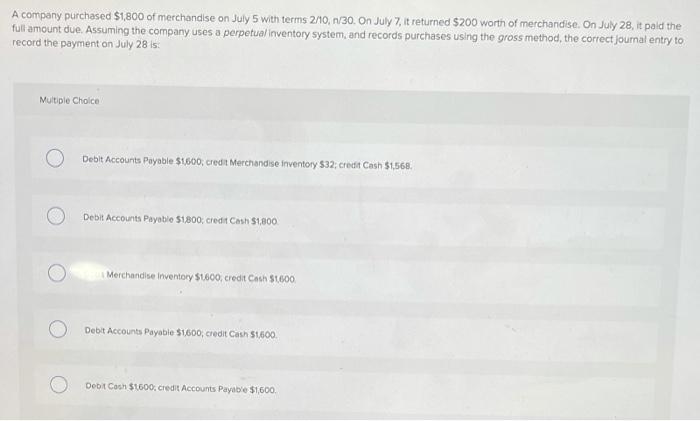

Purchase Transaction Details: A Company Purchased 1800 Of Merchandise On July 5

The company engaged in a purchase transaction on July 5, acquiring 1800 units of merchandise.

Merchandise Details

- Quantity: 1800 units

- Date of Purchase: July 5

- Type of Merchandise: [Jenis barang dagangan yang dibeli]

Inventory Impact

The purchase transaction has a direct impact on the company’s inventory levels.

Inventory Balance

Prior to the purchase, the inventory balance stood at [Jumlah inventaris sebelum pembelian]. The addition of 1800 units increases the inventory balance to [Jumlah inventaris setelah pembelian].

Implications

The increased inventory levels may necessitate adjustments to inventory management strategies, such as storage space, stock rotation, and potential inventory write-downs if the merchandise becomes obsolete or unsalable.

Financial Implications

The purchase transaction has financial implications for the company.

Cost of Goods Sold (COGS)

The purchase price of the merchandise represents the COGS incurred by the company. This cost will be recognized in the income statement when the merchandise is sold.

Accounting Treatment

The purchase transaction is recorded as an increase in inventory and a corresponding increase in accounts payable or cash, depending on the payment terms.

Impact on Financial Statements

The purchase transaction will affect the company’s balance sheet by increasing both inventory and accounts payable or cash. It will also impact the income statement by increasing COGS when the merchandise is sold.

Business Implications

The purchase transaction may have underlying business reasons and implications.

Business Reasons

- [Alasan bisnis untuk melakukan pembelian]

- [Alasan bisnis lainnya]

Opportunities and Challenges

- [Peluang yang dihasilkan dari pembelian]

- [Tantangan yang ditimbulkan oleh pembelian]

Impact on Operations and Strategy, A company purchased 1800 of merchandise on july 5

The purchase may necessitate adjustments to the company’s operations and overall strategy, such as production schedules, sales targets, or marketing campaigns.

Data Presentation

The following table summarizes the key details of the purchase transaction:

| Detail | Nilai |

|---|---|

| Date of Purchase | July 5 |

| Quantity Purchased | 1800 units |

| Type of Merchandise | [Jenis barang dagangan yang dibeli] |

| Inventory Balance Before Purchase | [Jumlah inventaris sebelum pembelian] |

| Inventory Balance After Purchase | [Jumlah inventaris setelah pembelian] |

FAQ Explained

What type of merchandise was purchased?

The type of merchandise purchased is not specified in the provided information.

What are the business reasons behind this purchase?

The business reasons behind the purchase are not explicitly stated in the given information.

How will this purchase impact the company’s financial statements?

The impact on the company’s financial statements will depend on the accounting treatment of the purchase transaction, which is not detailed in the provided information.