Delve into the captivating world of macroeconomics with our comprehensive Macroeconomics Unit 3 Test Answer Key. This meticulously crafted guide unravels the intricate concepts of economic growth, monetary and fiscal policies, international trade, and finance, providing a solid foundation for academic success.

Our expert insights illuminate the fundamentals of gross domestic product (GDP), central bank operations, government interventions, comparative advantage, exchange rate regimes, and the crucial role of international financial institutions. Engage with our lucid explanations and gain a profound understanding of the forces that shape economic landscapes.

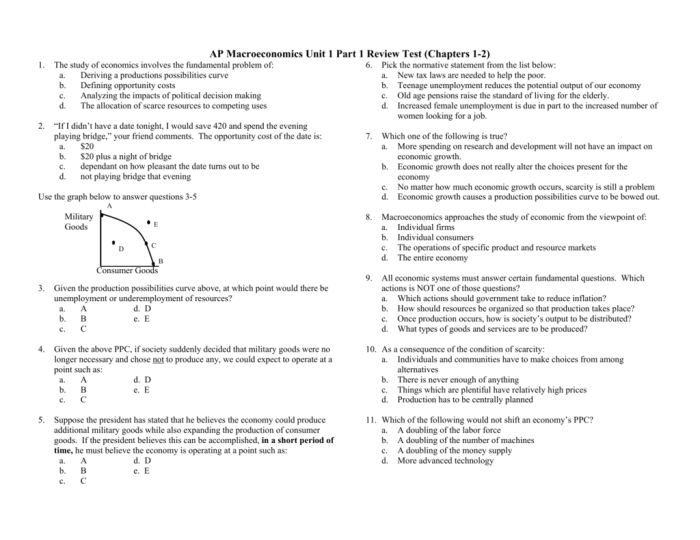

Macroeconomic Concepts

Macroeconomics examines the economy as a whole, focusing on broad measures such as gross domestic product (GDP), inflation, unemployment, and economic growth.

GDP is the total value of all goods and services produced within a country’s borders in a given period, typically a quarter or a year. It is a key indicator of economic activity and growth.

Components of GDP

- Consumption: Spending by households on goods and services

- Investment: Spending by businesses on new equipment, buildings, and inventories

- Government spending: Spending by government agencies on public goods and services

- Net exports: Exports minus imports

Relationship between GDP and Economic Growth

Economic growth refers to a sustained increase in GDP over time. Higher GDP typically indicates a higher standard of living and economic well-being.

Macroeconomic Indicators

- Inflation rate: Measures the change in the price level of goods and services

- Unemployment rate: Measures the percentage of the labor force that is unemployed

- Consumer confidence index: Measures the optimism of consumers about the economy

Monetary Policy: Macroeconomics Unit 3 Test Answer Key

Monetary policy is the set of actions taken by central banks to influence the money supply and interest rates in the economy.

Role of Central Banks

Central banks are responsible for managing the monetary system and regulating the financial sector.

Tools of Monetary Policy

- Open market operations: Buying and selling government bonds to increase or decrease the money supply

- Reserve requirements: The amount of money that banks are required to hold in reserve

- Discount rate: The interest rate that central banks charge banks for loans

Impact of Monetary Policy

Monetary policy can influence economic growth and inflation by affecting the cost and availability of credit.

Fiscal Policy

Fiscal policy is the use of government spending and taxation to influence the economy.

Role of Governments, Macroeconomics unit 3 test answer key

Governments use fiscal policy to manage economic activity, promote economic growth, and reduce unemployment.

Types of Fiscal Policy Measures

- Expansionary fiscal policy: Increases government spending or reduces taxes to stimulate economic growth

- Contractionary fiscal policy: Decreases government spending or increases taxes to slow down economic growth and reduce inflation

Impact of Fiscal Policy

Fiscal policy can have a significant impact on economic growth and inequality.

International Trade and Finance

International trade and finance involve the exchange of goods, services, and financial assets across borders.

Comparative Advantage

Comparative advantage is the ability of a country to produce a good or service more efficiently than other countries.

Exchange Rate Regimes

- Fixed exchange rate: The value of a currency is pegged to another currency or a basket of currencies

- Floating exchange rate: The value of a currency is determined by supply and demand in the foreign exchange market

International Financial Institutions

- International Monetary Fund (IMF): Provides financial assistance to countries facing economic crises

- World Bank: Provides loans and grants to developing countries

FAQ Corner

What is the significance of GDP in measuring economic performance?

GDP serves as a comprehensive indicator of a nation’s economic output, capturing the value of all goods and services produced within a specific time frame. It provides valuable insights into the overall health and growth trajectory of an economy.

How does monetary policy influence economic growth and inflation?

Central banks wield monetary policy tools to regulate the money supply, interest rates, and credit availability. By adjusting these levers, they can stimulate economic growth during downturns and curb inflation when the economy overheats.

What are the key components of fiscal policy?

Fiscal policy encompasses government spending, taxation, and borrowing. By altering these variables, governments can influence aggregate demand, economic growth, and income distribution.